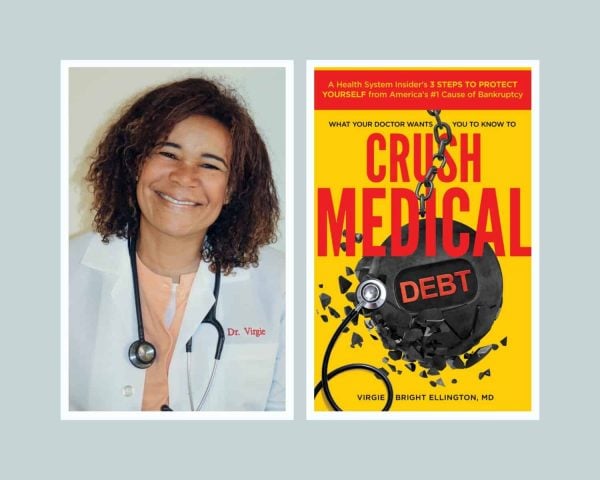

Medical debt is the No. 1 cause of bankruptcy in the U.S. But perhaps what is even more shocking is that medical bills often contain errors and most patients have no idea that they are paying their medical bills wrong, says Virgie Bright Ellington, M.D., an internal medicine physician, former insurance executive and the author of What Your Doctor Wants You to Know to Crush Medical Debt.

Dr. Virgie first became interested in medical debt after sharing a hospital room with a woman with young children who was coerced into agreeing to pay an exorbitant medical bill that would force her family into debt. That experience led Dr. Virgie to research how other people could avoid that fate and to come up with her three-step process.

She says that when patients receive a bill for any costly medical procedure, hospital stay, surgery, or ER visit they need to take three steps before paying it.

- Phone the hospital or medical provider to request an itemized bill that contains CPT (current procedural terminology) codes. These unique codes, one assigned for each medical service, determine how much Medicare would pay for it.

- With the CPT code or codes in hand, the patient should perform an internet search to determine the comparative prices that are associated with that bill. They should not pay more than that number.

- Negotiate with the hospital or provider and then set up a monthly payment plan that fits your budget.

To see how this would work, consider this example provided by Dr. Virgie.

Suppose a patient has received a bill from a hospital for a medical procedure and, after getting all the CPT codes associated with that procedure, discovers that the payment range should be around $1,000, a number far lower than the $5,000 price tag on the bill. According to Dr. Virgie, when the patient phones the hospital they should say, “Researching my case shows that the fair Medicare price is $1,000, which is actually the amount that I can fit into my budget at $100 a month. Can you tell me who I should speak with to get this payment plan interest-free?”

More information on this three-step process can be obtained by visiting www.crushmedicaldebt.com for more guidance.

READ MORE: As temperatures rise, Cigna offers Medicare Advantage customers free rides to cooling centers